Technological change is progressing at unprecedented speed and it is impacting profoundly societies and economies across the globe. There has been explosive growth in technology with the advent of AI or artificial intelligence and machine learning. The financial sector has witnessed tremendous innovations during the last few years. Fintech is certainly the new buzzword and is playing a pivotal role in the financial world thanks to its ever-changing consumer and corporate focus. Businesses are compelled to keep up constantly with the latest developments so that they could offer more choices and enhanced UX or User Experience.

We know that you need to pay attention to your overall financial life whether it is planning an effective debt payoff strategy or budgeting, or consistently monitoring your credit. You must devote your time and attention to managing and boosting your financial life. For this, you would require the most appropriate set of tools. Thanks to technological advancements, today you have access to a plethora of tools that would help you in curbing your expenses and maintaining a tight grip over your financial life. Debts are a reality in 2023 and consumer debt in the United States has reached $17 trillion. Hence, it is a good idea to keep track of your spending and keep your personal finances strictly under control.

Budgeting could be a pretty difficult task. However, sometimes it could prove to be even more overpowering to identify the right assistance. Cutting-edge budgeting and money management apps are introduced every few weeks so it is quite a challenging task to identify the best ones. After a lot of research, experts have come up with some of the best budgeting apps of 2023. Let us explore them.

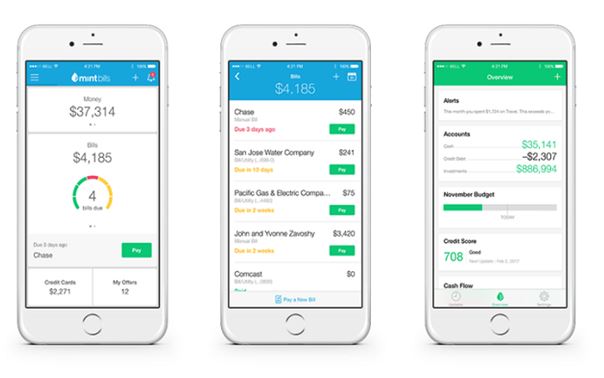

Mint

Mint is owned by Intuit, the company that has presented you with TurboTax and QuickBooks too. This predominantly budgeting app boasts numerous features that would be assisting you in managing personal finances from an extensive list of credit card issuers, banks, lenders, brokerages, and some other financial institutions. Mint is supposed to be the most renowned budgeting app and it allows users to chalk out budgets, keep track of bills, and even get a credit score free of cost. However, Mint has gained phenomenal popularity because of its incredibly useful budgeting feature.

You simply need to go about linking your bank, credit card, and loan accounts. Mint would be using relevant information and important data from those accounts and then recommend budgets as per your spending pattern. Your expenses are categorized for instance, as ‘Food & Dining’, ‘Entertainment’, or ‘Shopping’, etc. You would soon realize that you could save a substantial amount by reducing your expenses or spending in specific categories. You could get alerts as soon as you cross your budget. And You could keep tracking your overall cash flow and spending by category to get a comprehensive picture of exactly where all your money is going every month.

Mint has introduced an app called “MintSights”. This data-driven app is known to use all your relevant financial information to provide customized recommendations right from chalking out a first budget meticulously to effective debt consolidation to ways of boosting your investments. Mint could be used for free; however, it can make money simply by recommending certain offers like investing apps or new credit cards, to its users.

PocketGuard

PocketGuard plays a pivotal role in safeguarding you against overspending. This app would be linked to your financial accounts to efficiently keep track of what you are spending in comparison to the pre-determined budget during the month. This app could be set up easily and it is quite simple to connect it to your diverse bank accounts.

It is a brilliant app for monitoring precisely how much you earn, spend on recurring bills or daily expenses, and keeps aside as savings. This amazing budgeting app seems to have a special feature that could help you in tracking all your bills individually and spot any opportunities for saving. Moreover, PocketGuard keeps track of recurring bills from Internet, TV, and phone companies, for instance, and assists you in getting a much better deal in terms of your service costs per month. PocketGuard is an efficient budgeting app that is useful not only for keeping track of your budget but also for reducing your overall spending.

See also: Personal Finance Tips for the New Year

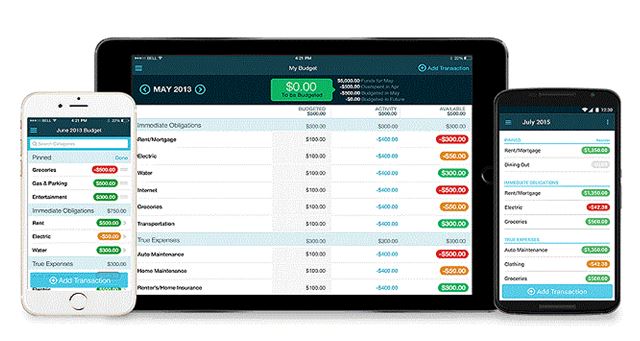

YNAB

You Need a Budget has achieved an immense fan following and phenomenal popularity. Instead of relying on conventional budgeting buckets, the app lets you chalk out or customize your unique budget based on your precise income, and every dollar would be accountable in the budget. Your income and spending right from your debt repayments to living expenses to investments and savings would be incorporated into your budget. When no dollar is left unaccounted for, you would be compelled to give a thought each time you spend a dollar.

YNAB is an excellent budgeting app for both couples and individuals who are serious about sticking to their budgets. It provides both mobile and desktop interfaces. You could opt for syncing your bank accounts either automatically or by entering expenses manually. YNAB also boasts of goal tracking and debt payoff features that inspire and motivate you to achieve your financial aspirations and goals.

Wally

Wally is a great app for budgeting. It is known for assisting you in tracking your expenses and income. It provides a snapshot of the rest of the budget to guide you against overspending. Wally is extremely popular and a major hit with Millennials. This app could be found in both Android and iPhone versions. The best characteristic of Wally is its support for practically all foreign currencies. This is a great choice for someone who is away from the country most of the time for business or pleasure trips.

Conclusion

73 percent of smartphone users have used an app to manage their finances in the past month. It is, therefore, clear that more and more people could consider improving their financial condition by using one or more of the above-discussed apps that have been designed for effectively managing your money. Remember that the key to building wealth is effectively managing your finances and spending with a proper budget and you could do that with the cutting-edge apps available today. The idea is to use them for financial stability and peace of mind.